On January 17, the National Bureau of Statistics released changes in the sales prices of commercial housing in 70 large and medium-sized cities in December 2024. In December 2024, among the 70 large and medium-sized cities, the sales prices of commercial housing in first-tier cities rose month-on-month, while the overall decline in second- and third-tier cities narrowed month-on-month; the year-on-year decline in first- and second- and third-tier cities continued to narrow.

Kang Yi, Director of the National Bureau of Statistics, said at the 2024 National Economic Operation Conference held on the same day that as rigid and improved housing demand continues to release, the market supply and demand relationship has improved, and housing prices have stabilized.

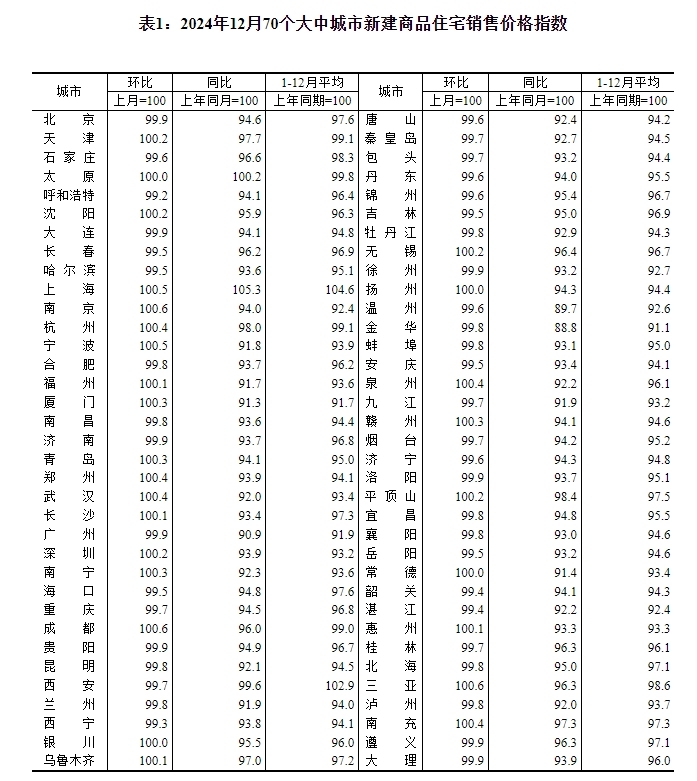

The number of cities with new housing rose month-on-month, hitting a new high in the past 18 months

From the perspective of the new housing market, in December 2024, the sales prices of newly built commercial housing in 23 of the 70 large and medium-sized cities rose month-on-month, an increase of 6 from November, and the number of cities with rising prices was the highest since July 2023. Among them, the sales prices of newly built commercial housing in first-tier cities rose by 0.2% month-on-month, which is the first increase since June 2023.

Data from the National Bureau of Statistics show that in December last year, among first-tier cities, Shanghai and Shenzhen rose 0.5% and 0.2% respectively, while Beijing and Guangzhou both fell 0.1%; the sales prices of newly built commercial housing in second-tier cities turned from a month-on-month decrease of 0.1% to a flat month-on-month decrease of 0.1% in third-tier cities; the sales prices of newly built commercial housing in third-tier cities fell 0.2% month-on-month, with a decrease narrowing by 0.1 percentage point.

Specifically, in December 2024, the sales prices of new homes in Nanjing, Chengdu and Sanya ranked among the top three on the month-on-month, with a month-on-month increase of 0.6%; Shanghai and Ningbo rose by 0.5% on the month-on-month. Among them, the prices of new homes in Shanghai have continued to grow positively since June 2022, and have been rising for 31 consecutive months on the month-on-month. The popularity of luxury house transactions has supported the strong trend of housing prices. New housing prices in many core cities such as Hangzhou, Zhengzhou, and Wuhan have also achieved positive growth month-on-month. In addition, about 60% of the cities showed a downward trend month-on-month, with the majority being third-tier cities. Among them, Hohhot and Xining ranked one or two in terms of month-on-month declines, down 0.8% and 0.7% respectively on the month-on-month.

Guan Rongxue, senior analyst at Linping Residence Big Data Research Institute, pointed out that after the "926 New Policy", the price trend of new houses has undergone positive changes, and the number of cities with prices has gradually increased, and the month-on-month decline has also narrowed significantly, basically returning to the level that is nearing the same level in June 2023, and signs of stabilization are approaching, which plays an important guiding role in the restoration of overall market confidence. With the significant loosening of housing purchase policies, both urgent needs and improved customer bases have increased, and prices have also ushered in a certain structural increase.

Kang Yi also said at the press conference that the policy effects were released together, and the main indicators of the real estate market continued to improve, driving market confidence to gradually increase. In December last year, a monthly housing price questionnaire survey conducted in 70 large and medium-sized cities showed that 69.3% of the respondents who expected the prices of newly built commercial housing to remain stable or increase in the next six months, an increase of 0.8 percentage points from the previous month.

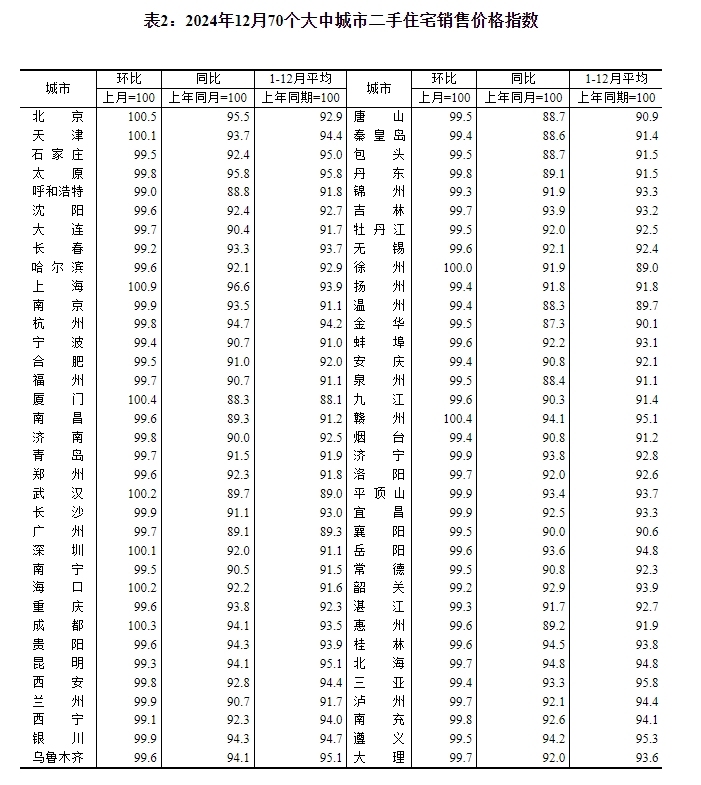

The prices of second-hand housing in first-tier cities have risen month-on-month for three consecutive months

From the second-hand housing market, the market has also steadily recovered. In December 2024, among the 70 large and medium-sized cities, 9 cities rose month-on-month, one city remained the same month-on-month, and the remaining 60 cities showed a downward trend in a single month.

Data from the National Bureau of Statistics shows that in December last year, the sales prices of second-hand residential properties in first-tier cities rose by 0.3% month-on-month, and have been rising month-on-month for three consecutive months. Among them, Beijing, Shanghai and Shenzhen rose by 0.5%, 0.9% and 0.1% respectively, while Guangzhou fell by 0.3%; second-hand residential properties in second-tier cities fell by 0.3% month-on-month, an increase of 0.1 percentage point from the previous month. Second-hand housing in third-tier cities fell by 0.4% month-on-month, with a decrease of 0.1 percentage point.

From the urban perspective, in December 2024, the cities with the increase in second-hand housing prices on a month-on-month basis were still mainly core first- and second-tier cities. Among them, Shanghai led the month-on-month basis by 0.9%, while the prices of second-hand housing prices in Beijing, Xiamen, Ganzhou, Chengdu, Wuhan, Haikou, Tianjin and Shenzhen also showed an upward trend on a month-on-month basis. In addition, Xuzhou's second-hand housing prices have stopped falling for two consecutive months; Hohhot and Xining ranked among the top two month-on-month declines, down 1% and 0.9% respectively.

58 Anjuke Research Institute Director Zhang Bo pointed out that according to the data released by the Bureau of Statistics, housing prices in first-tier cities have maintained an overall upward trend for three consecutive months, especially while second-hand housing prices have risen. As transaction volume remains high, the continuous increase in volume and price has shown a clear signal of "stop decline and stabilize".

From the data on Anjuke Online, the popularity of second-hand house search in the fourth quarter of 2024 increased by 50% compared with the same period in 2023. This significant increase is mainly attributed to the fact that this year's housing market stimulus policies focus on first-tier cities. Continuous policy incentives have effectively released the demand for home purchases. Guangzhou's housing search has increased the least year-on-year, but the four first-tier cities are all showing an upward trend, and it is particularly obvious to go north. Second-tier cities also show a point-like recovery pattern, and second-hand housing prices in cities such as Xiamen, Wuhan, Chengdu, and Tianjin show a weak recovery trend.

Zhang Bo believes that volume comes first, and transaction volume is the basis for stable housing prices. As long as the transaction volume of second-hand houses is still above the boom and bust line after the Spring Festival this year, the market heat can be maintained. Judging from the current situation, the small spring in hot first-tier cities after the Spring Festival is worth looking forward to. If policies can be properly assisted after the holiday, the certainty of the small spring will be stronger.