The gold price hits a new record high.

On April 16, the price of spot gold (London gold cash, the same below) broke through the two integer marks of $3,300/ounce and $3,310/ounce, setting a record high and hit a high of $3,317.89/ounce intraday.

However, international gold prices fluctuated and fell after continuous rises. As of press time, Wind data showed that the spot gold price was $3,293.20 per ounce, which had fallen below $3,300.

In terms of futures gold prices, Wind data shows that COMEX gold futures also showed an upward trend on Wednesday (April 16). As of press time, the highest price in the day was once at $3334.2/ounce.

In the domestic market, as of the close of Wednesday (April 16), the main 2506 contract of Shanghai Gold was 781.60 yuan/gram, up 2.68%, and the highest was 782.38 yuan/gram.

At the same time, the Shanghai Gold Exchange "Shanghai Gold" price also rose as of the close of April 3. Among them, the closing price of the Shanghai Gold Au99.99 contract is 762.90 yuan/gram, with a maximum price of 765.30 yuan/gram; the closing price of the Au100g contract is 765.00 yuan/gram; the closing price of the Au99.95 contract is 760.50 yuan/gram, with a maximum price of 763.50 yuan/gram.

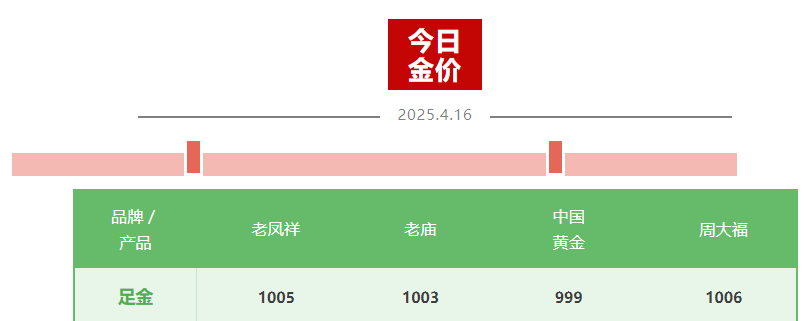

It is worth mentioning that as gold prices at home and abroad continue to rise, the prices of physical gold have also hit new highs. On April 16, the quotations of gold jewelry from many brand gold stores exceeded 1,000 yuan per gram, and the domestic gold jewelry price entered the era of 1,000 yuan.

Data from the Shanghai Gold Jewelry Industry Association shows that in terms of the price of full gold, Lao Fengxiang reported 1,005 yuan/gram, Lao Miao reported 1,003 yuan/gram, China Gold reported 999 yuan/gram, and Chow Tai Fu bid was 1,006 yuan/gram. In addition, Chow Fu’s 999 was 1,006 yuan/gram, and Chow Fu’s 999.9 was 1,026 yuan/gram.

Regarding the "risk rise" of gold prices at home and abroad, many analysts pointed out that the main reason is the strengthening of safe-haven and anti-inflation attributes.

In terms of safe-haven, CITIC Futures pointed out that concerns about escalating trade tensions continue to boost demand for safe-haven gold. At the same time, the Federal Reserve may adopt a more radical expectation of interest rate cuts in 2025, and the market's bet on the Fed's easing policy has deepened, coupled with the weakening trend of the US dollar, jointly providing support for gold prices.

"At present, the downward risks of the US economy cannot be ignored. The US Michigan Consumer Confidence Index has declined for four consecutive months. In the future, the negative impact of trade conflicts and driving away immigrants on the US economy will gradually be reflected, and the weakening pressure of US economic data may further intensify. Continuing concerns about weakening the US economy and the still complex global geopolitical situation will continue to cause safe-haven demand, thereby continuing to support gold prices." Guomao Futures said.

In terms of anti-inflation, Guomao Futures analyzed that although the United States' CP1 and PPI fell across the board in March, it still takes time for Trump's trade policy to transmit consumer prices, so the relevant impact has not yet been reflected in the current inflation data. Combined with the speeches of Federal Reserve officials and the analysis of overseas market institutions, the impact of trade policies on prices is likely to begin to be significantly reflected this summer, when gold's anti-inflation attributes are expected to continue to boost its price rise.

"As of April 11, the holdings of the world's largest gold ETF-SPDR, have flowed in more than 81 tons since Trump took office, up about 9.3%, and the holding level has reached 953.15 tons, indicating that investors in Western countries' demand for future risk aversion and combating inflation continue to strengthen." Guomao Futures further pointed out.

However, it is worth noting that although the logic to support the continued rise of gold prices in the medium and long term still exists and the possibility of strengthening is not ruled out, at the current time, many institutions have prompted the risk of a phased high adjustment of gold prices.

For example, CITIC Futures pointed out that in the next quarter, gold will remain bullish in the second quarter, but gold may have a risk of fluctuation in the short term. Among them, London gold can pay attention to support of US$3,200, with a weekly range of US$3,174 to US$3,245.

"Overall, gold hedges the monetary attributes of US dollar credit risks, as well as the safe-haven attributes and anti-inflation attributes, and support the continued rise of gold prices in the medium and long term. Investors are advised to still focus on gold allocation." Guomao Futures further pointed out, "But because gold prices are at an absolute historical high, Fed officials and U.S. Treasury Secretary have all suggested that if necessary, they will save the U.S. bond market. The selling strength in the short-term U.S. bond market is expected to slow down, so we still need to be wary of the risk of phased high adjustments in gold prices."