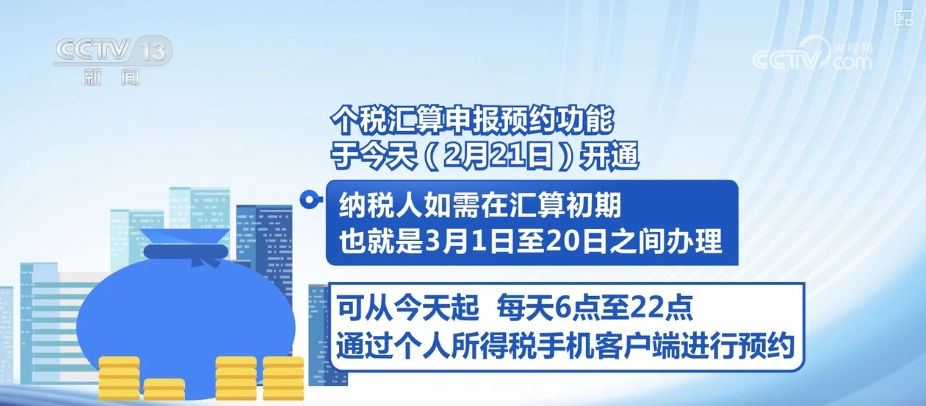

CCTV News: The reporter learned from the State Administration of Taxation that the 2024 personal income tax settlement will be conducted from March 1 to June 30, and the declaration and appointment function will be launched on February 21. If taxpayers need to handle the transaction in the early stage of reconciliation, that is, from March 1 to 20, you can make an appointment through the personal income tax mobile client from 6:00 to 22:00 every day from February 21st. From March 21 to June 30, taxpayers can handle it at any time without making an appointment.

Who needs to apply for personal income tax reconciliation?

What are the personal income tax reconciliation? Who needs to handle it?

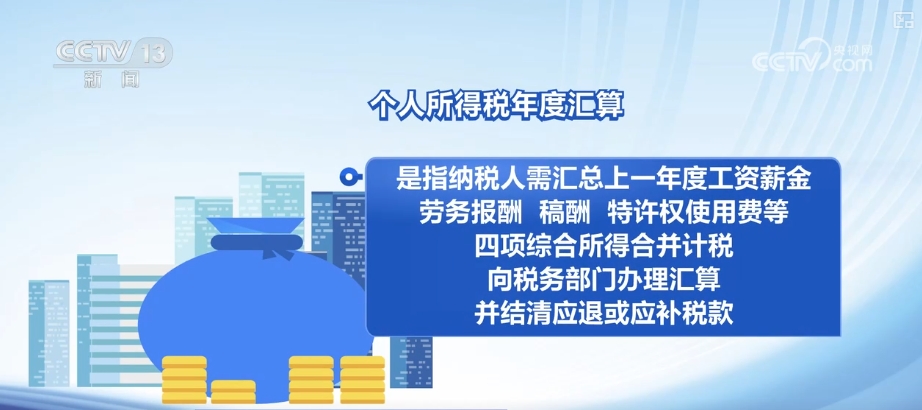

The annual reconciliation of personal income tax refers to the taxpayer who needs to summarize the previous year's wages and salary, labor remuneration, royalties, and royalties to consolidate the taxes, and handle the reconciliation with the tax department and settle the refund or reimbursement of the tax. If one of the following circumstances meets one of the following circumstances, the taxpayer needs to handle the reconciliation:

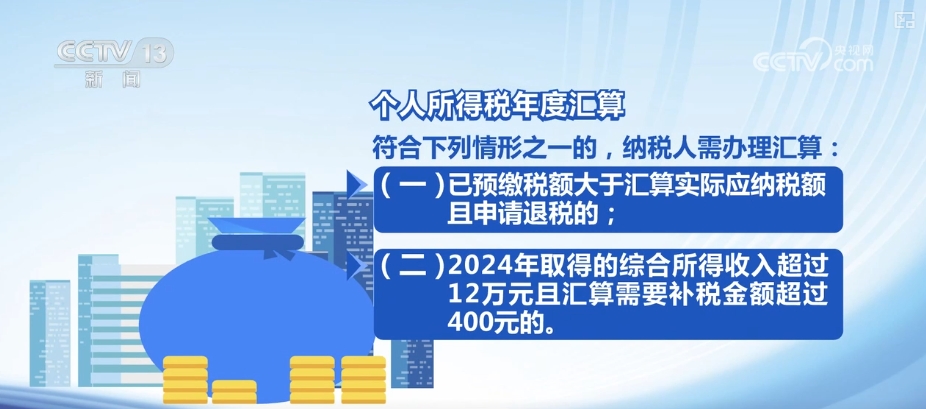

(I) The prepaid tax amount is greater than the actual tax payable and a tax refund is applied for; (II) The comprehensive income obtained in 2024 exceeds 120,000 yuan and the reconciliation amount requires tax replenishment exceeds 400 yuan.

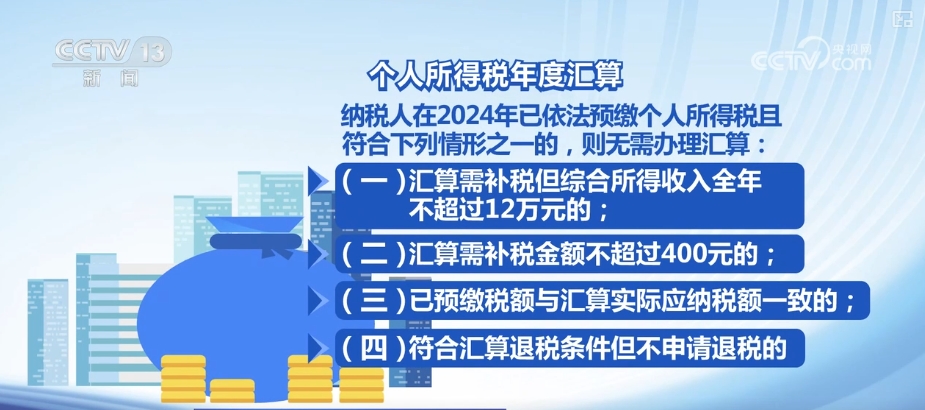

If the taxpayer has prepaid personal income tax in 2024 and meets one of the following circumstances, he does not need to go through reconciliation: (1) The reconciliation requires tax reimbursement but the comprehensive income does not exceed RMB 120,000 in the whole year; (2) The reconciliation requires tax reimbursement not exceed RMB 400; (3) The prepaid tax reimbursement is consistent with the actual taxable amount of the reconciliation; (4) Those who meet the reconciliation tax reimbursement but do not apply for tax reimbursement.

Taxpayers can log in to the personal income tax mobile client, and the system will automatically calculate the tax you should compensate or refund. Simply put, if your comprehensive income does not exceed 120,000 yuan in 2024, no matter how much your tax reimbursement amount is, there is no need to handle annual reconciliation. If your annual tax is not more than 400 yuan, there is no need to handle reconciliation. How to handle personal income tax reconciliation?

How should taxpayers handle annual personal income tax reconciliation?

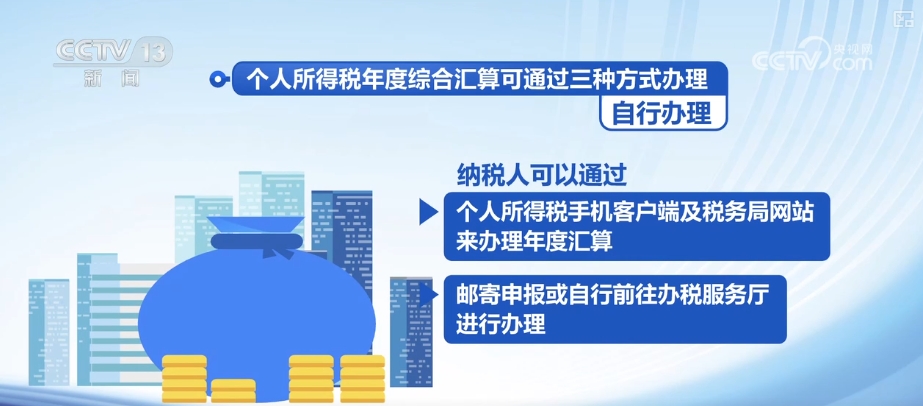

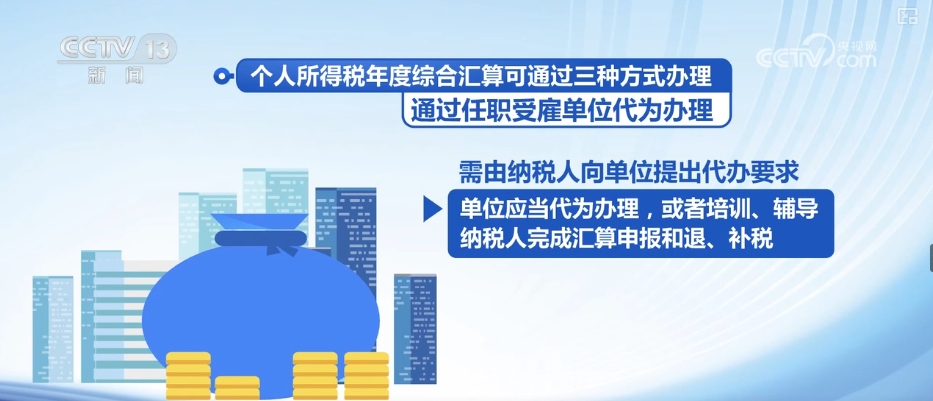

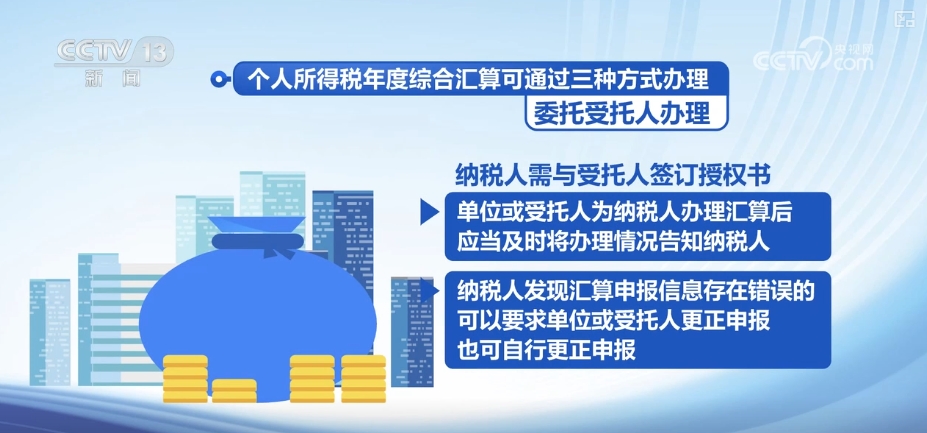

According to reports, the comprehensive annual settlement of personal income tax can be handled by oneself, through the employing unit, and entrust the trustee to handle it.

If you handle it yourself, the taxpayer can handle the annual reconciliation through the personal income tax mobile client and the tax bureau website, or you can file a declaration by mail or go to the tax service hall by yourself.

If the handling is carried out by the employing unit, the taxpayer must submit an agency request to the unit. The unit shall handle the handling on its behalf, or train or tutor the taxpayer to complete the settlement declaration, refund and reimbursement.

If the trustee is entrusted to handle the matter, the taxpayer must sign a letter of authorization with the trustee. After the unit or trustee handles the reconciliation for the taxpayer, it shall promptly inform the taxpayer of the handling situation. If a taxpayer finds that there is an error in the reconciliation declaration information, he or she may ask the unit or trustee to correct the declaration, or correct the declaration by himself. Social security, etc. can be filled in or supplementary deductions during the personal income tax reconciliation period

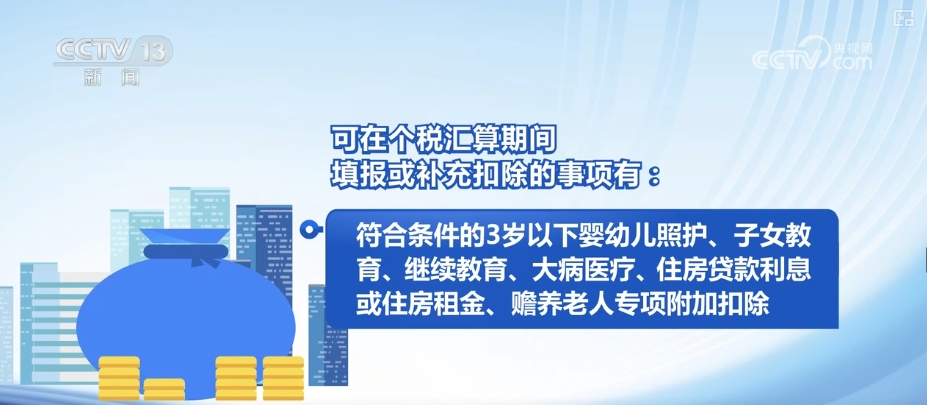

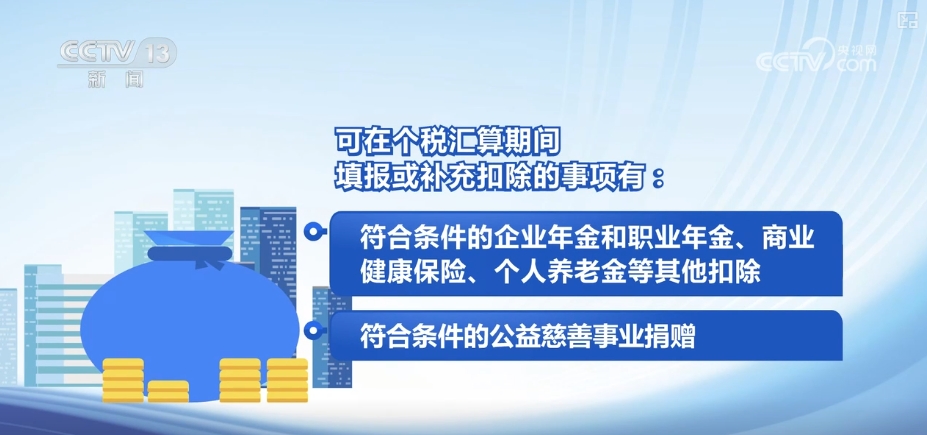

According to reports, taxpayers can fill in or supplementary deductions for pre-tax deductions in 2024, such as three insurances and one fund, special additional deductions, etc., during the personal income tax reconciliation period. Matters that can be filled in or supplemented for deductions during the personal income tax reconciliation period include:

Deducting fees of 60,000 yuan, as well as special deductions such as social insurance premiums and housing provident fund that meet the conditions;

Eligible infants and young children under the age of 3 who are under the age of 3 who are eligible for care, children's education, continuing education, serious illness medical care, housing loan interest or housing rent, and special additional deductions for support for the elderly;

Eligible corporate annuities and occupational annuities, commercial health insurance, personal pension and other deductions; eligible public welfare and charity donations.